News Releases

Financial Report for the Fiscal Year Ended March 2024

Mori Trust Group recently announced its consolidated business performance for the year ended March 31, 2024 (FY 2024).

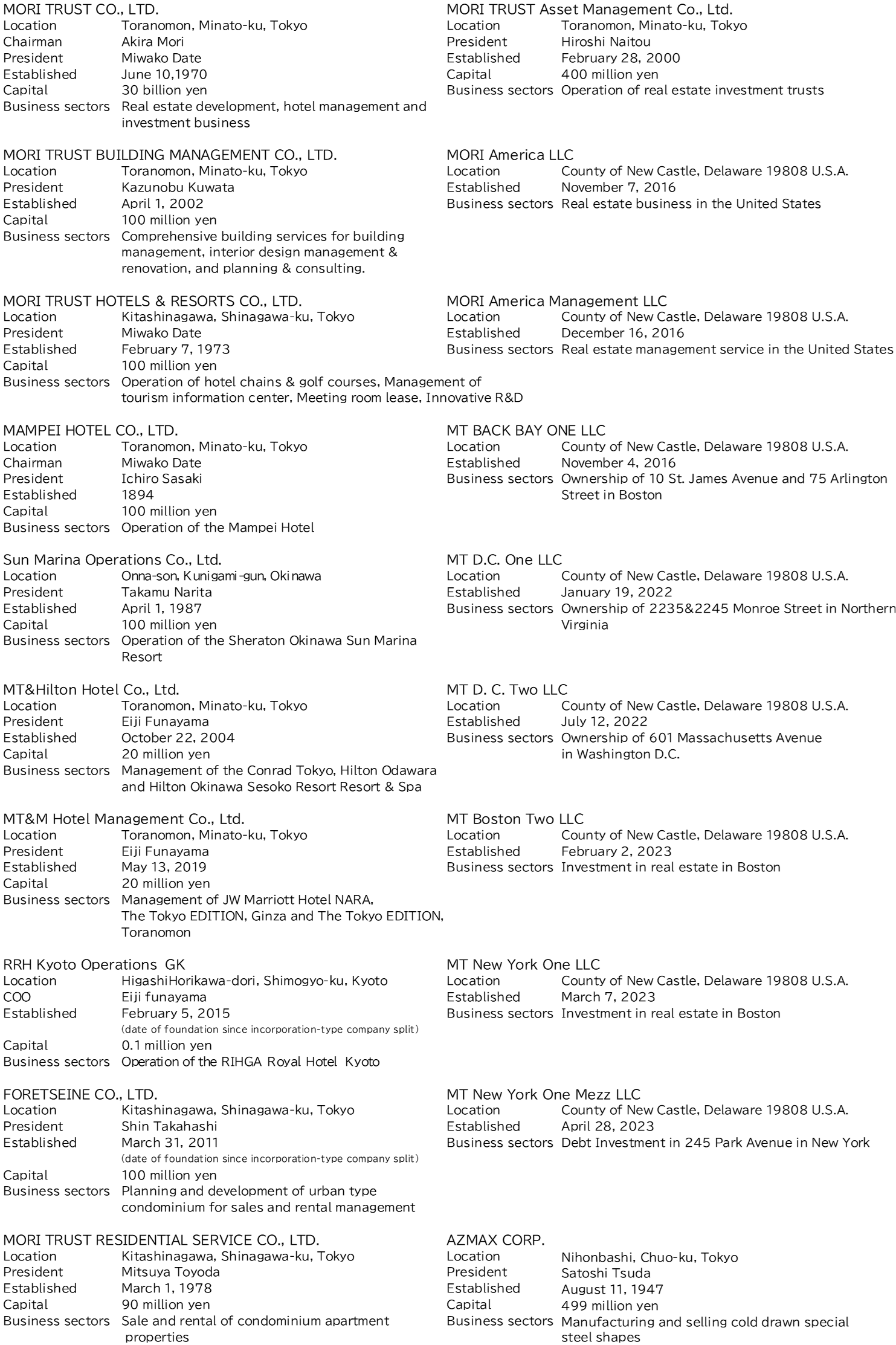

The Group consists of 41 consolidated companies, including Mori Trust Co., Ltd., Mori Trust Building Management Co., Ltd., and Mori Trust Hotels & Resorts Co., Ltd., and three equity-method affiliates.

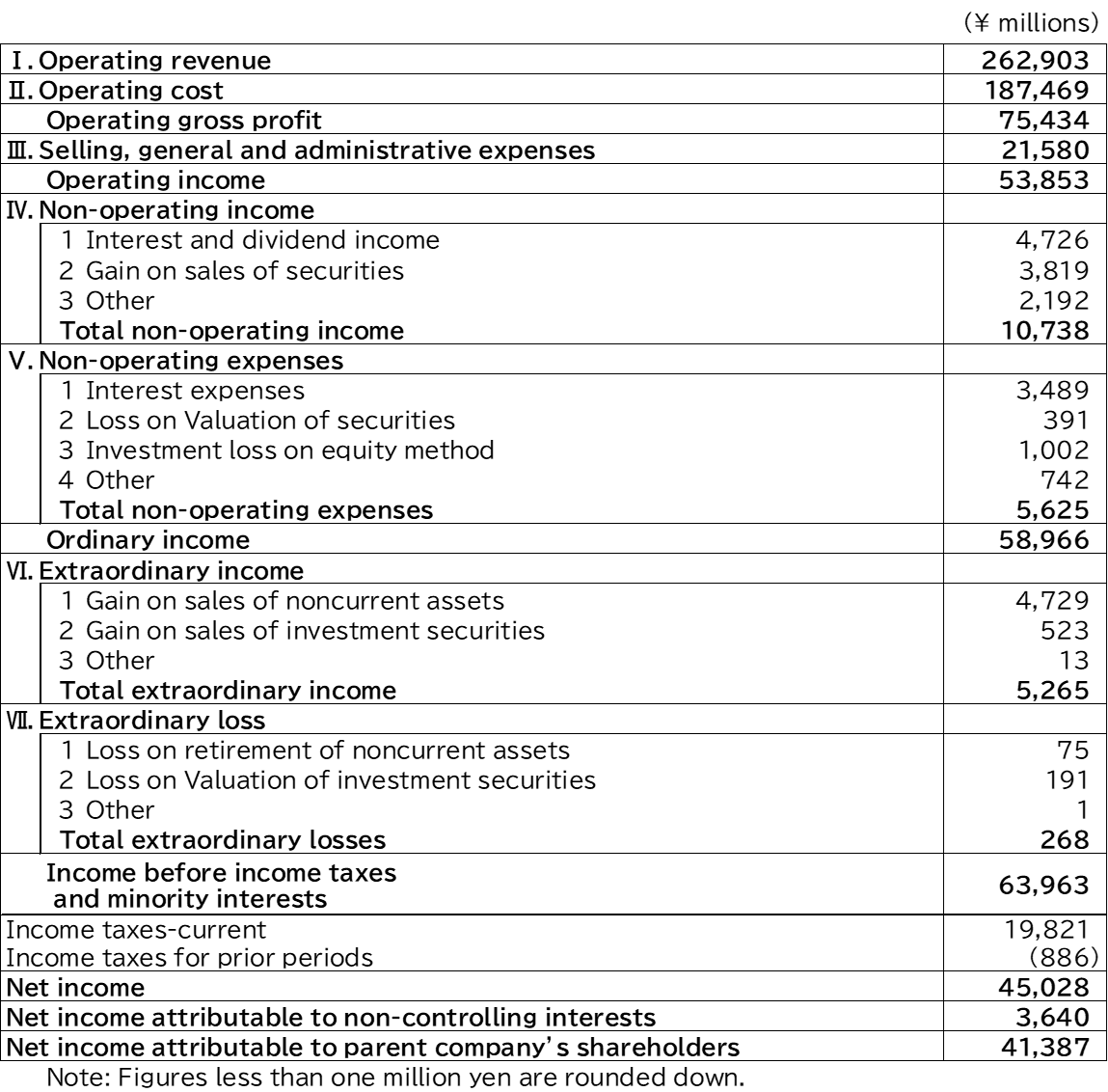

[Mori Trust Group Consolidated Financial Report] (April 1, 2023 – March 31, 2024)

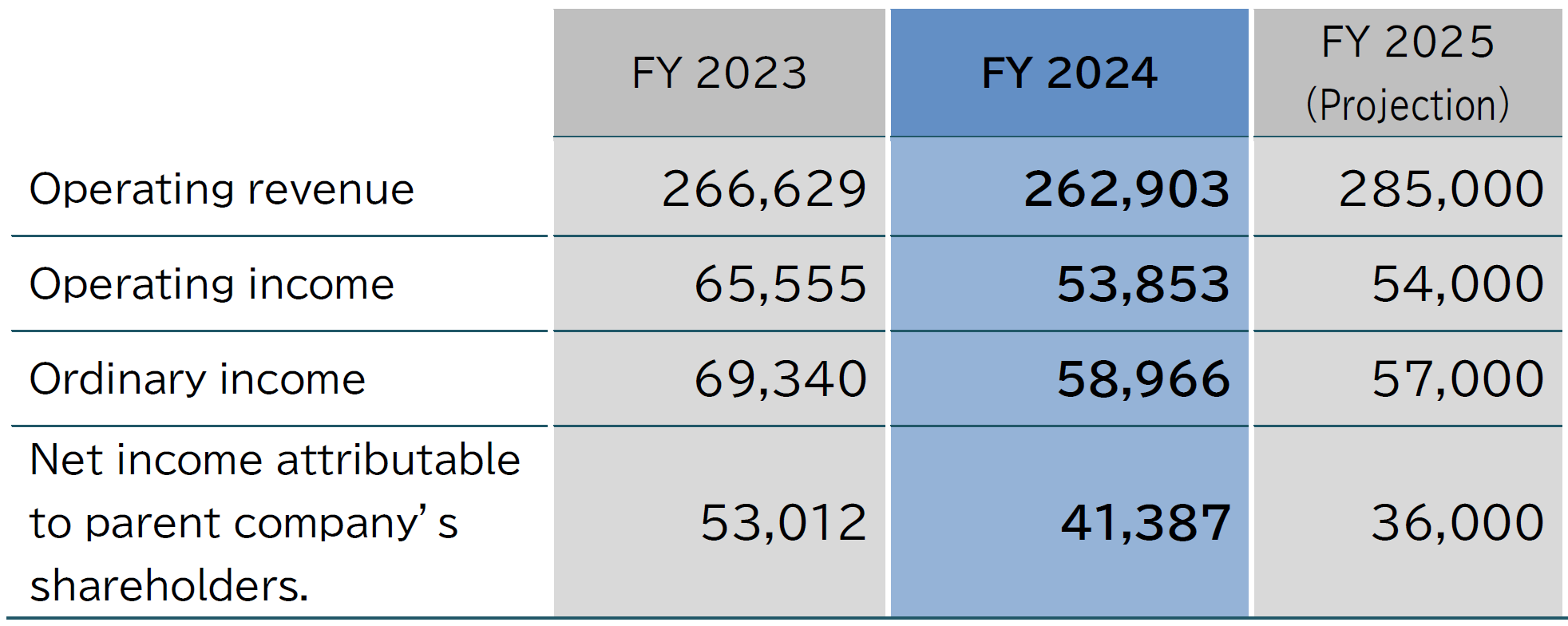

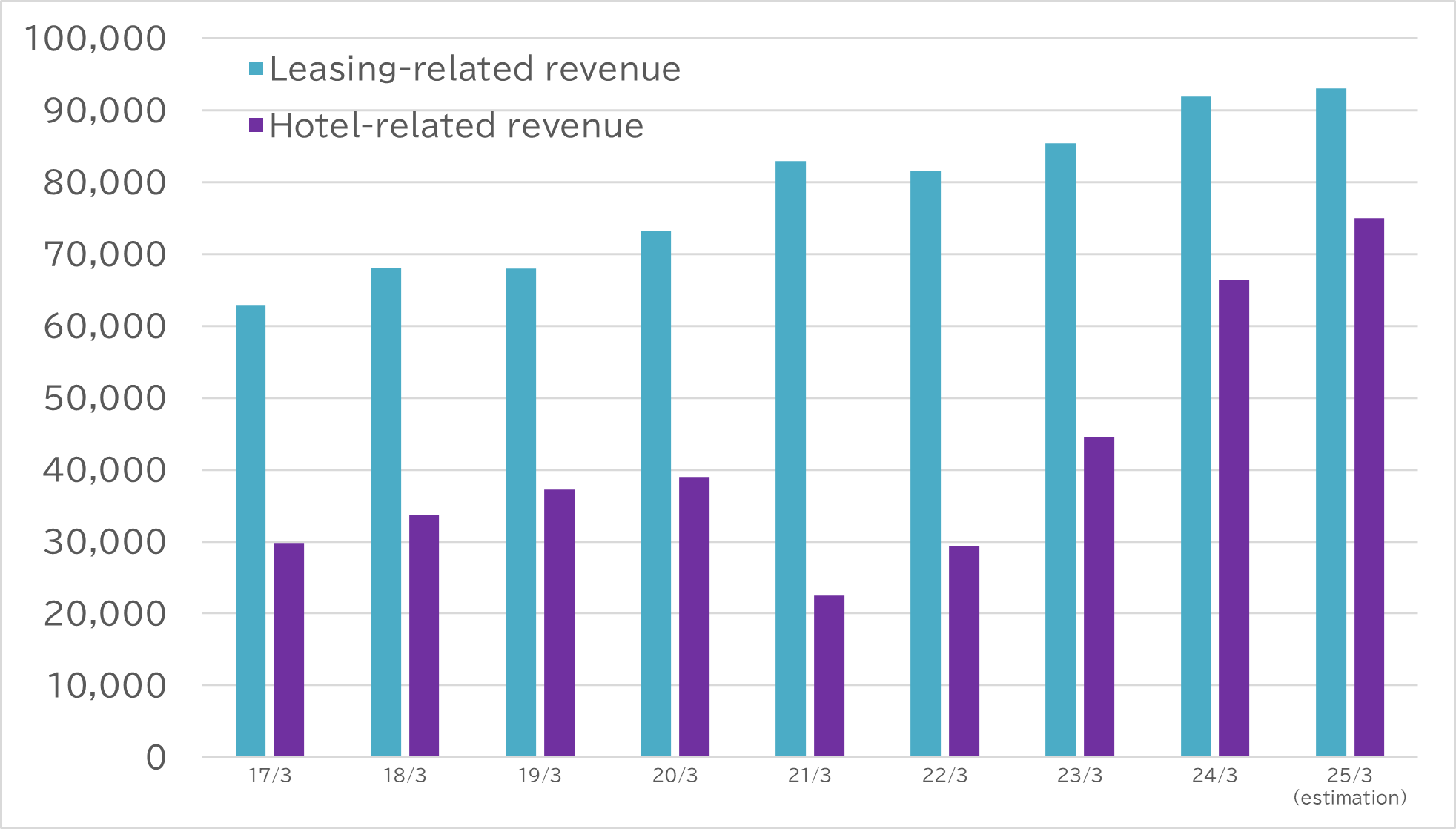

- For the fiscal year ended March 2024, operating revenue was 262.9 billion yen (down 1.4% year-on-year) and operating income was 53.8 billion yen (down 17.8% year-on-year). In addition to the acquisition of multiple properties in the United States, improvements in the operation of existing office buildings and improved hotel occupancy rates due to the transition to Class 5 status of COVID-19 contributed to record highs for both leasing-related and hotel-related revenue. On the other hand, real estate sales revenue decreased due to sales adjustments and other factors, resulting in lower revenues and earnings.

- Ordinary income decreased to 58.9 billion yen (down 15.0% from the previous year), and net income attributable to owners of the parent decreased to 41.3 billion yen (down 21.9% year-on-year).

- In the forecast for the fiscal year ending March 2025, both leasing-related and hotel-related revenues are expected to increase for the third consecutive year, resulting in an overall increase in operating revenue to 285.0 billion yen (up 8.4% year-on-year). Operating income is expected to be 54.0 billion yen (up 0.3% year-on-year), and net income attributable to owners of the parent is expected to be 36.0 billion yen (down 13.0% year-on-year).

(Figures in millions of yen; figures less than one million yen are rounded down.)

Operating revenue breakdown

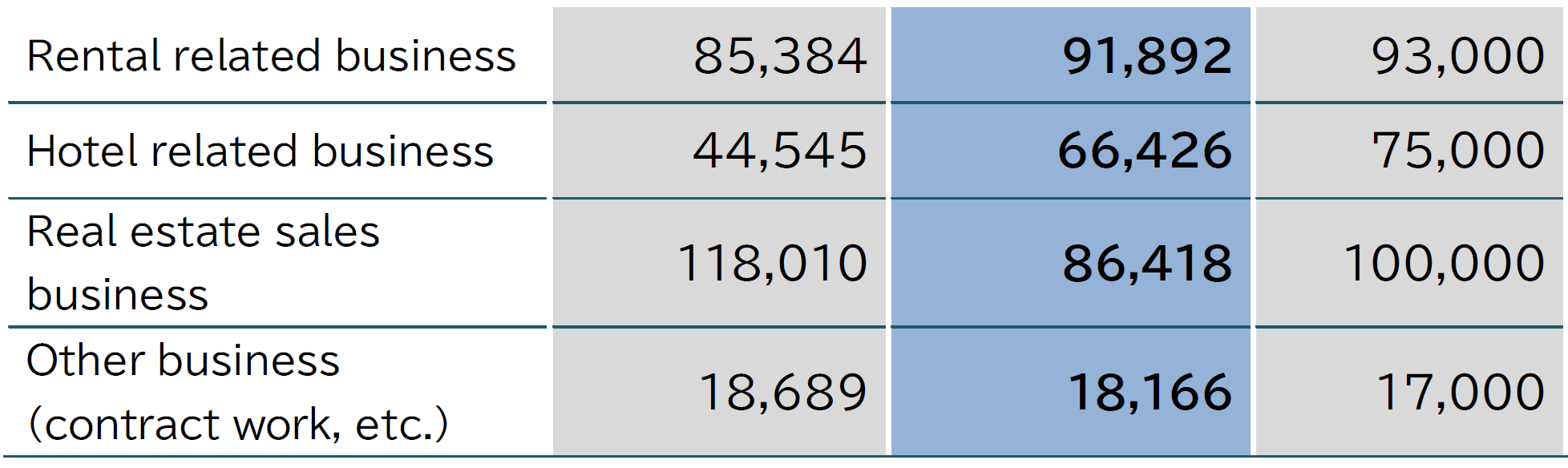

Total assets and net assets

Highlights of FY2024 Business Performance

- Leasing-related business posted a record operating revenue of 91.8 billion yen, an increase of 7.6% year-on-year and the highest ever for the second consecutive period, due to the full-year operation of 601 Massachusetts Avenue in Washington, D.C., which was acquired in August 2022, and improved occupancy rates of existing office buildings.

- In the hotel related business, the occupancy rate of all existing hotels in City Hotels and Resort Hotels was significantly improved due to the impact of the transition of COVID-19 to Class 5 in May 2023. Additionally, with the acquisition of the RIHGA Royal Hotel Kyoto in May of the same year and the opening of the Shisui Luxury Collection Hotel Nara in August of the same year, operating revenue increased 49.1% year-on-year to 66.4 billion yen, the highest ever for the second consecutive period.

- In real estate sales business, condominium sales by Eslead Corporation continued to perform well from the previous year, but sales adjustments meant that operating revenue decreased 26.8% year-on-year to 86.4 billion yen, and in other businesses, operating revenue decreased 2.8% year-on-year to 18.1 billion yen.

As a result of the above, operating revenue was 262.9 billion yen, operating income was 53.8 billion yen, and net income attributable to owners of the parent was 41.3 billion yen.

Business Performance Projections for FY2025

- In the leasing-related business, we expect operating revenue to reach a record high of 93 billion yen for the third consecutive fiscal year, mainly due to improvements in the occupancy rate of existing office buildings, as we emerge from the slump in the office market caused by COVID-19 that has continued since 2020.

- Regarding the hotel related business, we plan to open the Mampei Hotel and Hotel Indigo Nagasaki Glover Street this fiscal year. In addition, as the first full fiscal year of operation since the transition of COVID-19 to Class 5 status is expected to further improve occupancy rates at existing hotels, we expect operating revenue of 75 billion yen, the highest in our history for the third consecutive fiscal year.

- The real estate sales business is expected to generate operating revenues of 100 billion yen, mainly for the residential sales business, and other business is expected to generate operating revenues of 17 billion yen.

As a result of the above, business performance for the fiscal year ending March 2025 is expected to see operating revenue of 285 billion yen, operating income of 54 billion yen, and net income attributable to owners of the parent of 36 billion yen.

※Projections contained in this document have been made on the basis of information available when it was released. Due to various unforeseeable factors, actual performance may differ from such projections.

Financial Conditions of Mori Trust Group

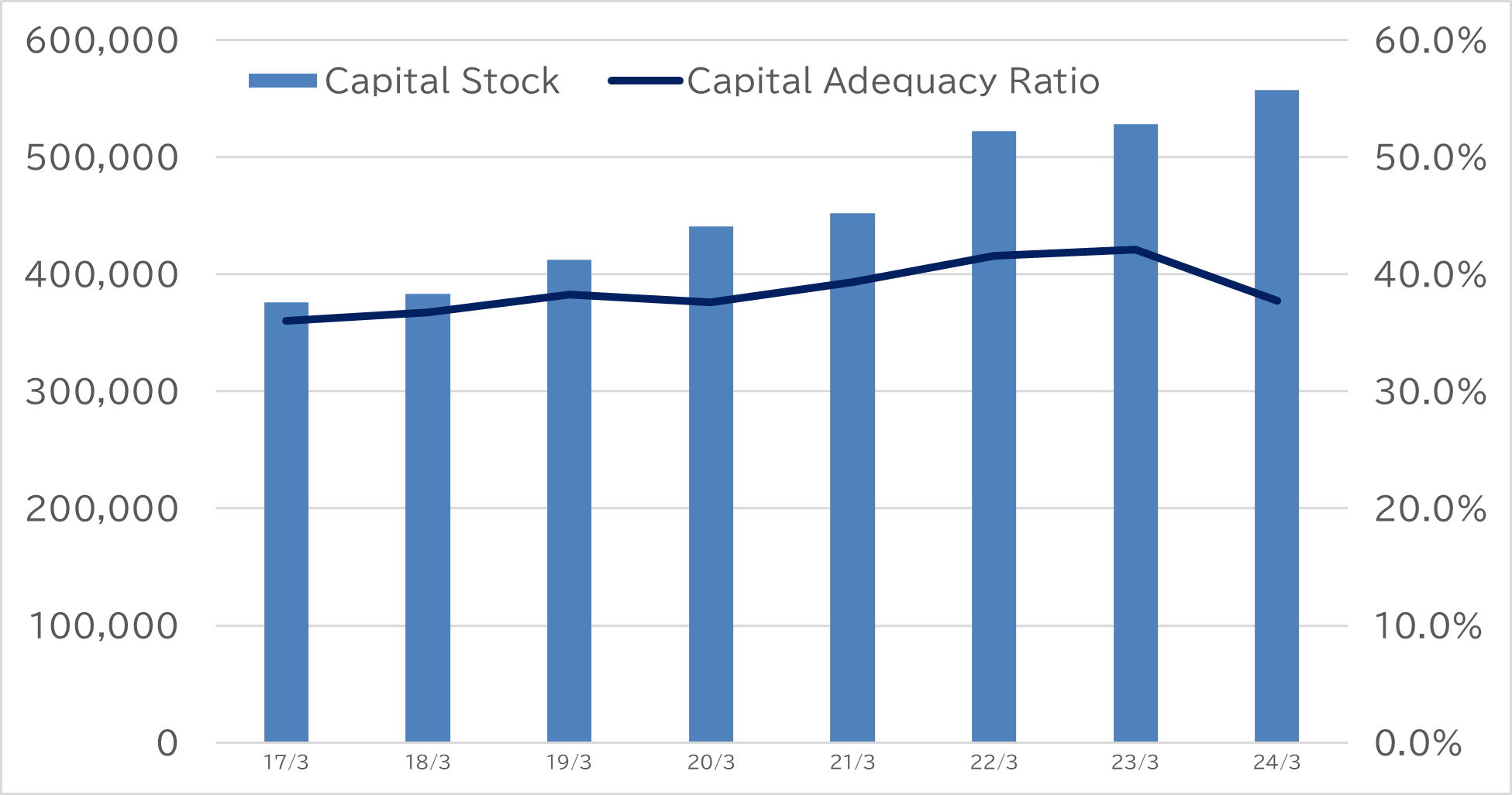

Trends of Capital Stock and Capital Adequacy Ratio

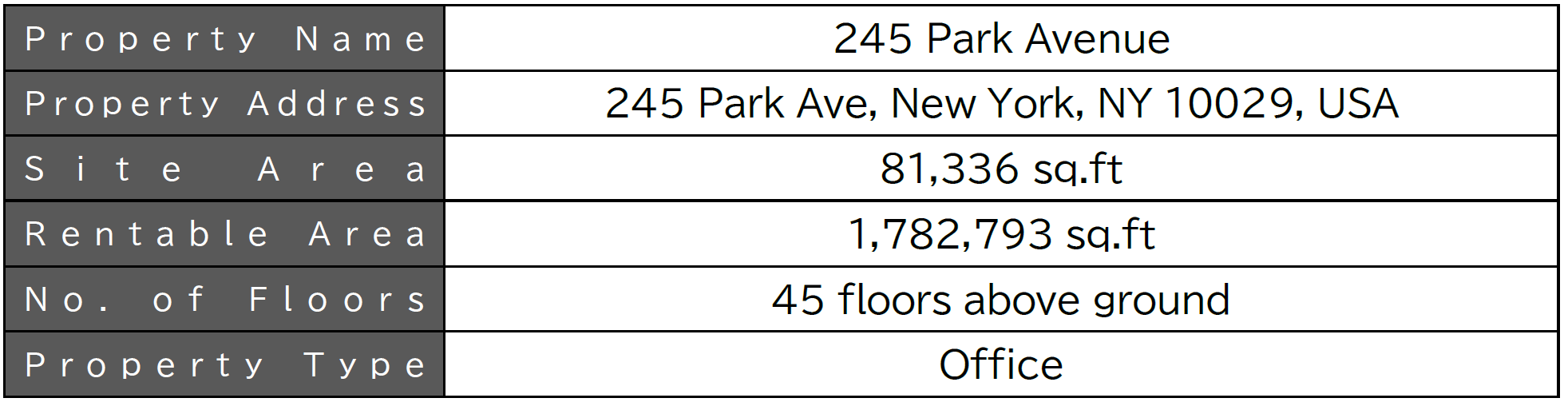

In the fiscal year ending March 2024, the capital stock was 557.3 billion yen and capital adequacy ratio was 37.7%, down 4.4% year-on-year, due to investments in the U.S. office building 245 Park Avenue, the RIHGA Royal Hotel Kyoto, and the Fairfield by Marriott Osaka Namba, among others.

Trends of Lease-related and Hotel-related Businesses

In the fiscal year ending March 2024, both leasing-related revenue and hotel-related revenue reached record highs.

Advance2030

Advance2030 Numerical Targets

Mori Trust Group’s medium-to long-term vision, “Advance2027,” formulated in 2016, was revised in November 2023 to become “Advance2030,” setting a new investment target of 1.2 trillion yen for fiscal 2030, as well as targets of sales of 330 billion yen and operating income of 70 billion yen for fiscal 2030.

Advance2023 Action Plans

(1) Real Estate Business (Leasing and Sales)

| i) Selection and concentration | Intensive investment in areas where we can be highly competitive |

| ii) Optimal combinations | Optimally combine functions to maximize the characteristics of land |

| iii) Strengthening international city functions | Contribute to the kind of urban development which serves to contribute to the strengthening of Japan’s international competitiveness |

(2) Hotel & Resorts Business

| i) Communicating the brand of Japan | Leverage abundant tourism resources to communicate the charm of Japan to the rest of the world |

| ii) Global standards | Providing services based on international standards and global lifestyles to the Japanese market |

| iii) Innovation | Creating new value by integrating Japanese culture with services that are based on international standards |

| iv) Aiming for Japan to become an advanced country in terms of tourism | Contributing through business to the establishment of Japan’s status as an advanced country when it comes to tourism |

(3) Investment Business

In order to build an optimal business and asset portfolio in a manner having us promptly responding to the times, we will ensure that our investments focus on stability, sustainability, and growth potential through the deployment of variety of investment methods for all businesses serving to bring value to greater society.

FY2024 Key Business Topics

REAL ESTATE

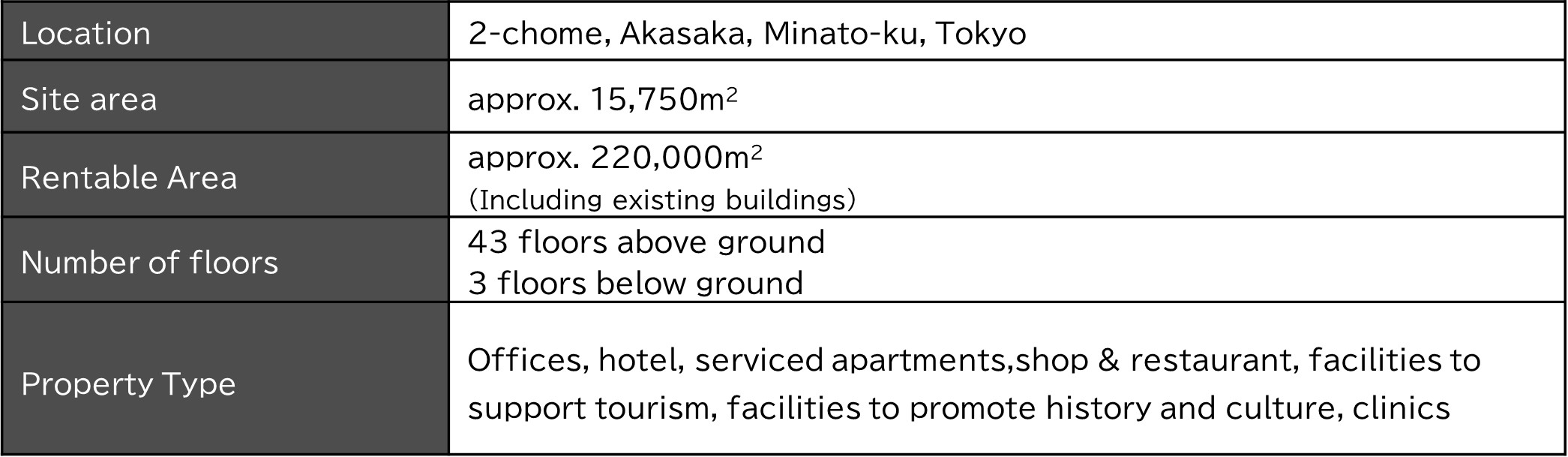

Tokyo World Gate Akasaka, a project in central Tokyo, is under development for its grand opening in 2025. As for overseas investment, a key strategy set forth in the medium- to long-term vision “Advance2030,” Mori Trust is participating it its first overseas real estate development project in Boston, Massachusetts, in the United States. In addition, we are renovating 245 Park Avenue, an office building in Manhattan, New York, for 2025. We also moved our headquarters to the Tokyo World Gate Kamiyacho Trust Tower for the first time in 24 years.

Tokyo World Gate Akasaka/Akasaka Trust Tower

Based on the district concept “Next Destination: Meet Up Again in the City,”we are promoting development with the aim of creating a city that will become a destination for diverse people to meet again and interact with each other in the future.

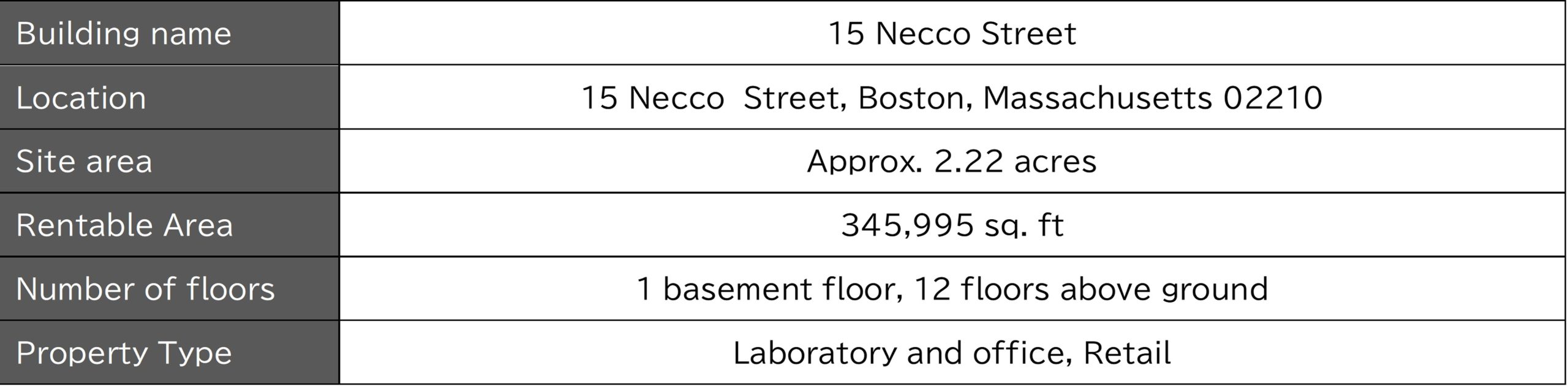

Participation in development in Boston, Massachusetts, U.S.A.

Through Mori America LLC, our U.S. subsidiary, we participated in the development of the laboratory and office development.

This property is a laboratory and office that responds to the growing interest in the life science field and demand for research facilities as a result of the global pandemic experience and the rapid development of advanced therapeutic drug science.

Participation in an investment and renovation project in an office building in Manhattan, New York, USA

Through Mori America LLC, we invested in the office building 245 Park Avenue and participated in the renovation of the property. Located in the Midtown Area, the economic and cultural capital of Manhattan, the largest city in the United States, the Property is jointly owned by SL Green Realty Corp., Manhattan’s largest real estate company, and will be renovated for 2025. Our total investment in the property and renovations is expected to be 100 billion yen.

Mori Trust’s new office (Tokyo World Gate/Kamiyacho Trust Tower)

At our new headquarters, which we moved to in May 2023, we have enhanced employee engagement through our “DESTINATION OFFICE” vision for our office business, and added together the idea of a versatile office space that creates a new office that continues to be a desirable destination.

In addition, we began offering “WORK SELECT”, a service that will contribute to the growth of our customers by providing even stronger support for office operations that meet the needs of workers and society.

【Reference】“WORK SELECT” service started

Mori Trust Building Management offers “WORK SELECT,” a service that proposes and supports office creation to companies that have issues with their current offices or are considering relocating their offices.

Mori Trust Group’s accumulated knowledge and experience can be utilized to provide one-stop support for all phases of office construction, thereby streamlining costs and schedules and helping to realize the ideal office.

HOTELS & RESORTS

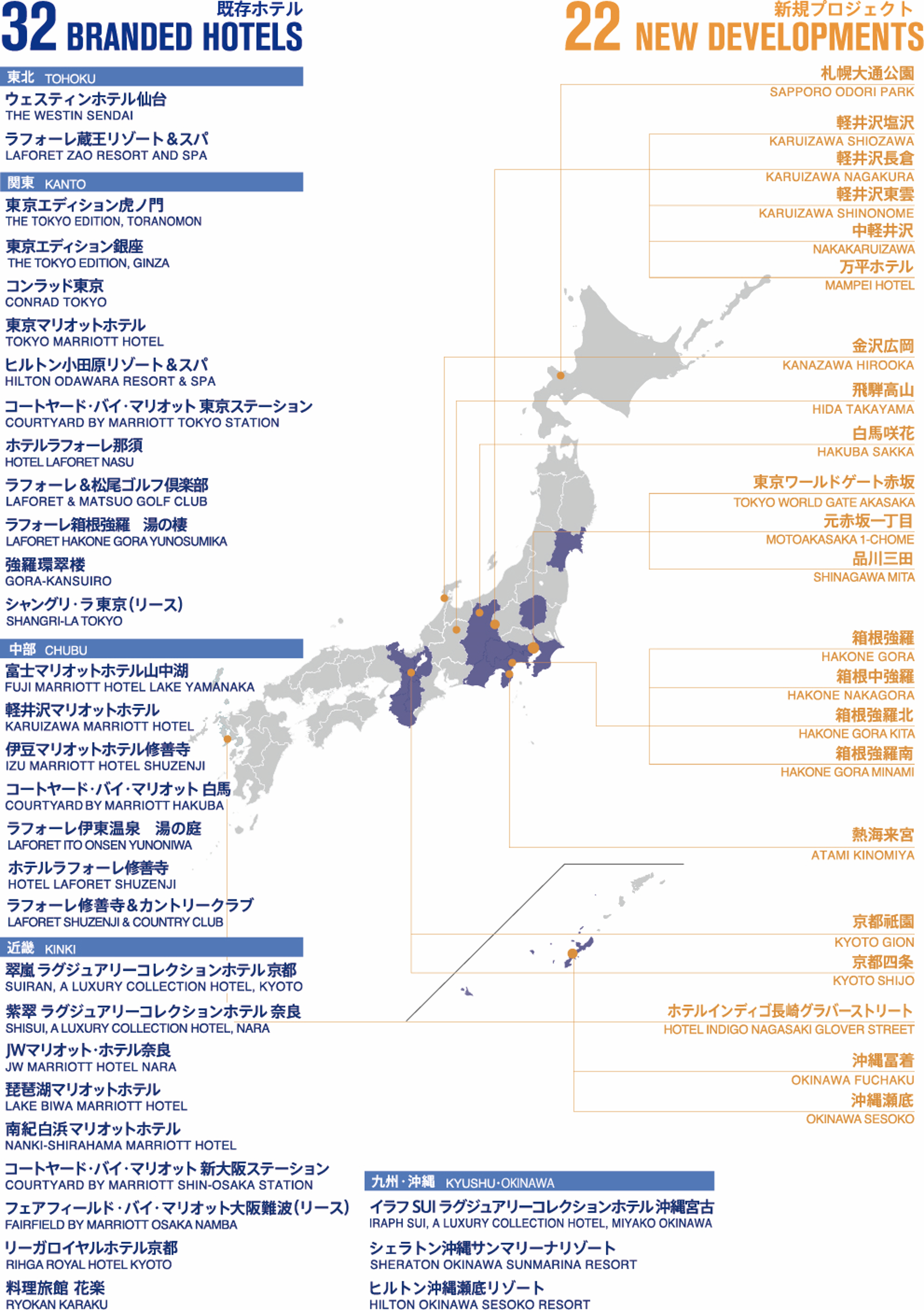

As of March 2024, the Mori Trust Group had 32 hotel facilities across Japan in its Hotel & Resort business, which is the core business of the Mori Trust Group, and was promoting 22 new hotel plans. In the fiscal year ending March 2024, we acquired two hotels in the Kansai area, where demand is expected to grow. Under the “Luxury Destination Network” concept,* we are promoting initiatives aimed at expanding inbound demand and increasing the cost per traveler. We are providing both domestic and international travelers with comfortable stays that take advantage of the attractive tourism resources in Japan.

List of existing hotels and new hotel projects

Luxury Destination Network concept: Mori Trust Group has a “Luxury Destination Network” concept to attract international hotels to various regions in Japan, in addition to Tokyo and Kyoto, which are the golden routes for tourism.

Hotels Opening in the Fiscal Year Ending March 2024

Shisui, a Luxury Collection Hotel, Nara

This project is being promoted in Nara Prefecture’s public-private partnership project, “Yoshikien’s Surrounding Area Preservation, Management, and Utilization Project.” The hotel opened in August 2023 as the third double-branded hotel in Japan under the “SUI” and “Luxury Collection” luxury hotel brands.

The Tokyo EDITION, Ginza

It opened in March 2024 in the Ginza 2-Chome area, the heart of Ginza, Japan’s leading commercial district, home to many world-renowned luxury fashion and high jewelry brands. We aim to contribute to the sustainable development of the Ginza area as a new landmark that attracts global tourists.

Laforet Hakone Gora Yunosumika Ayano-kan Annex

Based on the concept of “Immersion through the five senses and creating rich times,” the hotel opened in January 2024 as a place with high-quality facilities in harmony with the nature of Hakone and attentive service where Hakone can be enjoyed through the five senses.

Acquisition of RIHGA Royal Hotel Kyoto

We acquired RIHGA Royal Hotel Kyoto in May 2023.

This large hotel with approximately 500 rooms is located approximately a 7-minute walk from Kyoto Station, within walking distance of World Heritage sites such as Toji Temple and Nishi Honganji Temple. This prestigious hotel has been loved by the local Kyoto community for over 50 years since it first opened in 1969, and underwent a major renovation in 2016.

Acquisition of Fairfield by Marriott Osaka Namba

In January 2024, we acquired the Fairfield by Marriott Osaka Namba, located approximately a five-minute walk from Namba Station, Osaka’s second terminal station, marking our first foray into the Osaka Namba area. Located in an area where tourism demand is expected to grow in the medium to long term, this hotel specializes in accommodation, welcoming tourists from both Japan and abroad by providing reliable services and a warm, comfortable space.

(Reference) Hotels scheduled to be developed

Major renovation project for Mampei Hotel

This is a major renovation project for Mampei Hotel, which will celebrate its 130th anniversary in 2024. This project aims to preserve the tradition as a valuable historic landmark in the history of hotels in Japan, and to provide a dignified stay at a classic hotel for a long time to come. (scheduled to open in summer 2024)

Hotel Indigo Nagasaki Glover Street

The Minamiyamate district in Nagasaki is a tourist attraction with an exotic and cosmopolitan atmosphere. The opening of the West Kyushu Shinkansen line is expected to further develop tourism in this area, and we have invited Hotel Indigo, a lifestyle boutique hotel brand operated by IHG Hotels & Resorts, to join us. (Scheduled to open in the winter of 2024 to 2025)

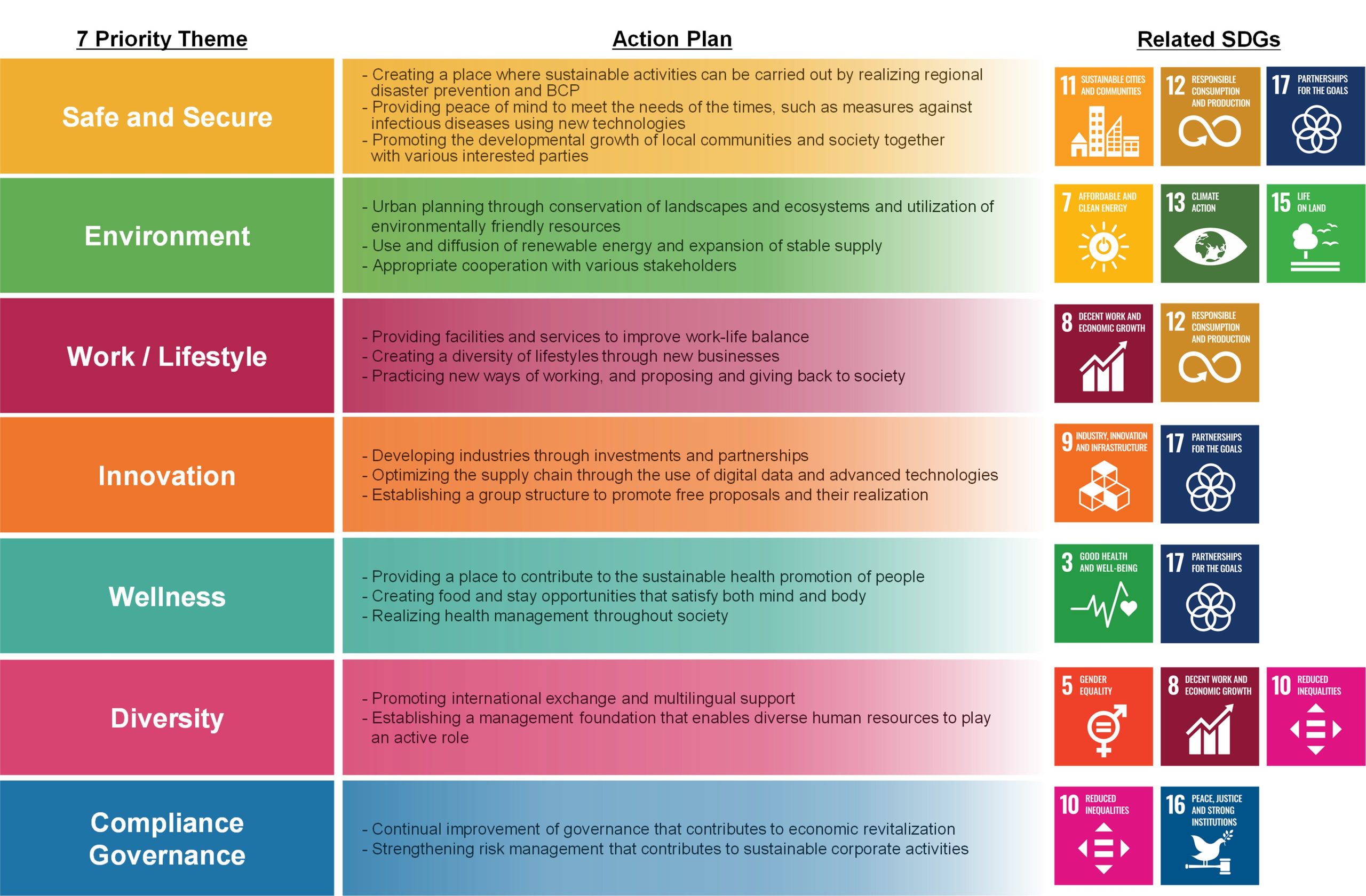

Sustainability Activity Report

Mori Trust Sustainability Vision

From Urban Planning to Future Planning

Under our corporate slogan “Create the Future,” we aim to create an exciting future.

Just as our mission once changed from building planning to urban planning, creating a new society will change us along with society.

Results of Initiatives in the Fiscal Year Ended March 2024 (Excerpt)

Safe and secure urban planning and community revitalization

- Provision of a lounge space open to the local community

Number of actual users of TOKYO WORLD GATE CoCo Lounge: 235,418

- Local community-building through area management activities

Number of events held in Kamiyacho, Gotenyama, Marunouchi and Sendai areas: 16

- Preparation for safety by conducting disaster drills

Number of disaster drills conducted: 5

Realization of a sustainable environment and society

- Introduction of renewable energy power to rental buildings

Introduction to nine new rental buildings: 88.1% progress rate ( target rate of introduction to rental buildings by FY2025: 100%)

- Acquisition of environmental certifications for rental buildings

Certifications acquired: 3(15 Necco Street 、245 Park Avenue、Kamiyacho Trust Tower)

Reduction in plastic use for hotel amenities by approximately 15 tons

Mori Trust Hotels & Resorts is implementing initiatives to reduce the plastic contained in hotel amenities used at the 18 hotels it operates, 16 tons per annum, by 15 tons by FY2024.

[1] Replacement with wood, bamboo, andproducts containing less plastic.

[2] Initiatives to encourage guests to bring their own amenities with them.

[3] Abolishment of some free hotel amenities.

Proposal of new work and life styles

- Acquisition of certifications for the workplace environment

Acquisition of the Health and Productivity Management Organization certification for five consecutive years

Creation of a new era and development of industries

- Exhibitions and sales that contribute to dissemination of culture and industries.

Actual exhibition and sales activities at TOKYO WORLD GATE CoCo Lounge: Permanent exhibitions for 37 weeks

Promotion of wellness and health

- Promotion of projects in the wellness field

Development and sales of health-conscious or environmentally friendly lunch boxes

Sales of home-grown herbal teas

Introduction of pure wellness rooms: 21 facilities

- Childcare leave acquisition rate

Acquisition rate: Total 69.6%, female 100.0%, male 66.7% (target by FY2025: 100%)

Initiatives for diversity

- Support for foreign residents with life concierges

Number of cases handled by concierges at TOKYO WORLD GATE CoCo Lounge: 2,378

- Implementation of recruitment activities with an awareness of diversity

Quotas for international students and innovation recruitment in the recruitment of new graduates, and comeback recruitment and referral recruitment in the mid-career recruitment

Continuous improvement of compliance and governance

- Strengthening of Mori Trust Group’s legal functions

Number of group legal meetings held: 4

Number of in-house seminars:3

- Raising awareness of management against information leakage

Implementation of crisis management simulations

Mori Trust Group: Total Floor Area Leased or Managed

Number of rental/managed facilities (as of March 31, 2024)

Buildings, housing, and commercial facilities: 64

Hotel & resort facilities: 35 (number of rooms: approx. 5,300)

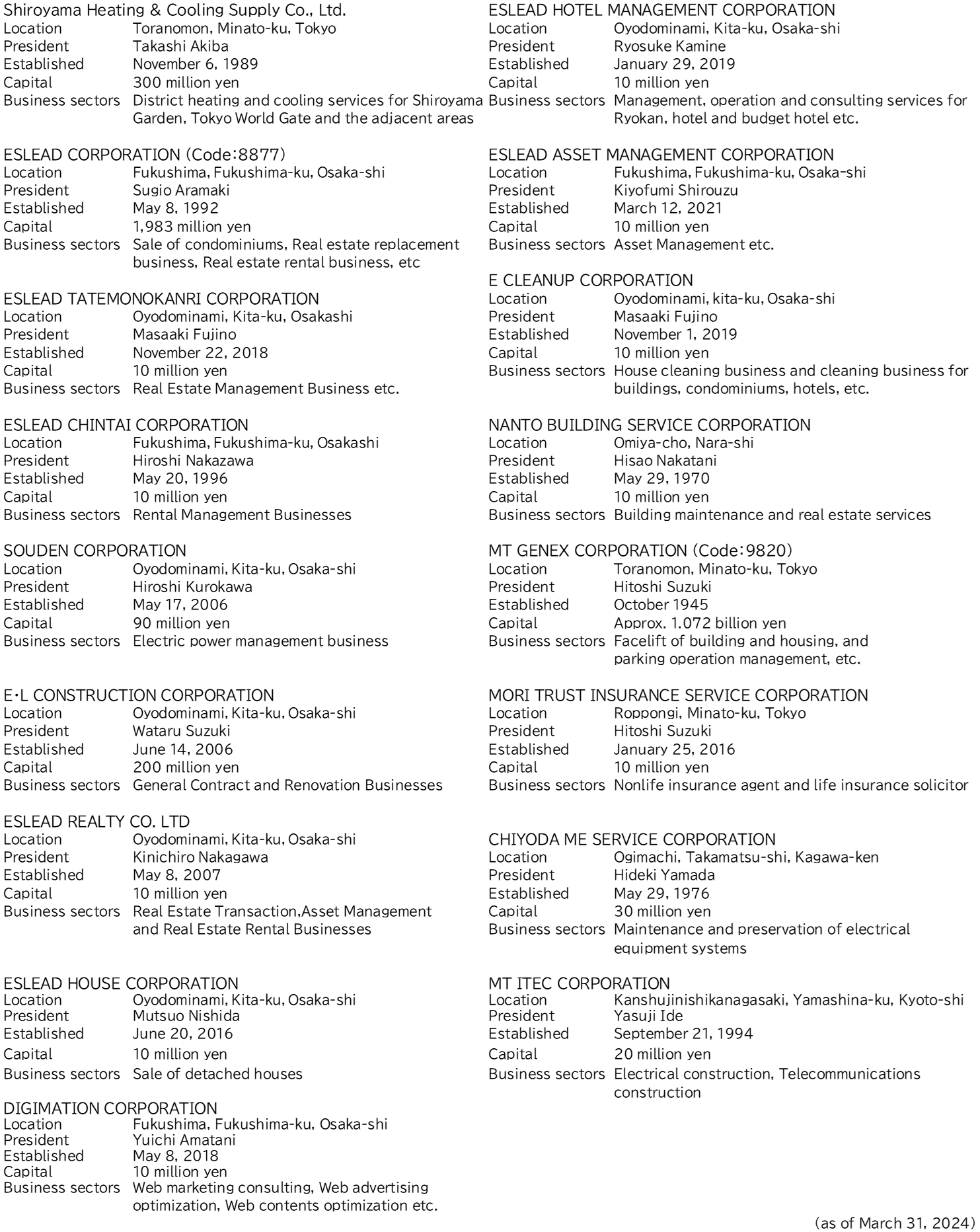

Mori Trust Group: Summary of Consolidated Companies

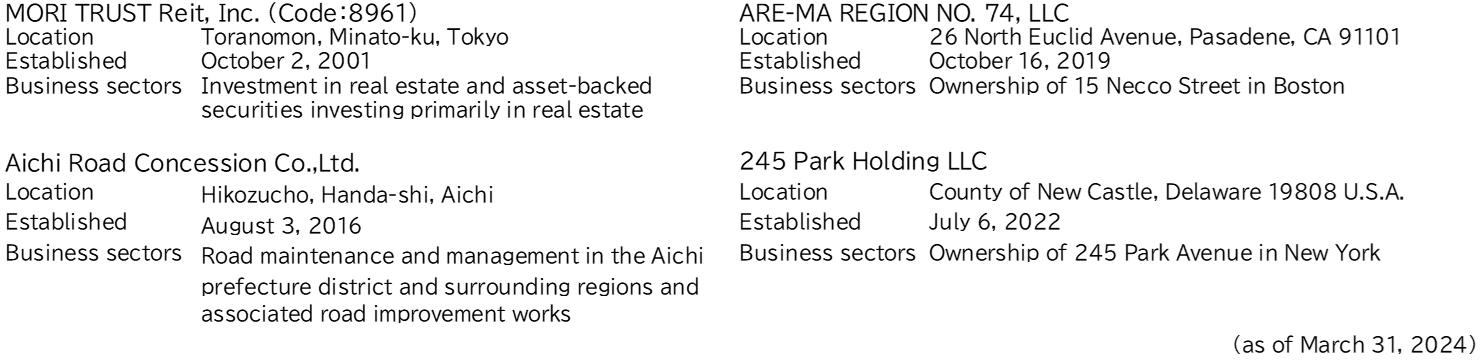

Mori Trust Group: Summary of Equity – Method

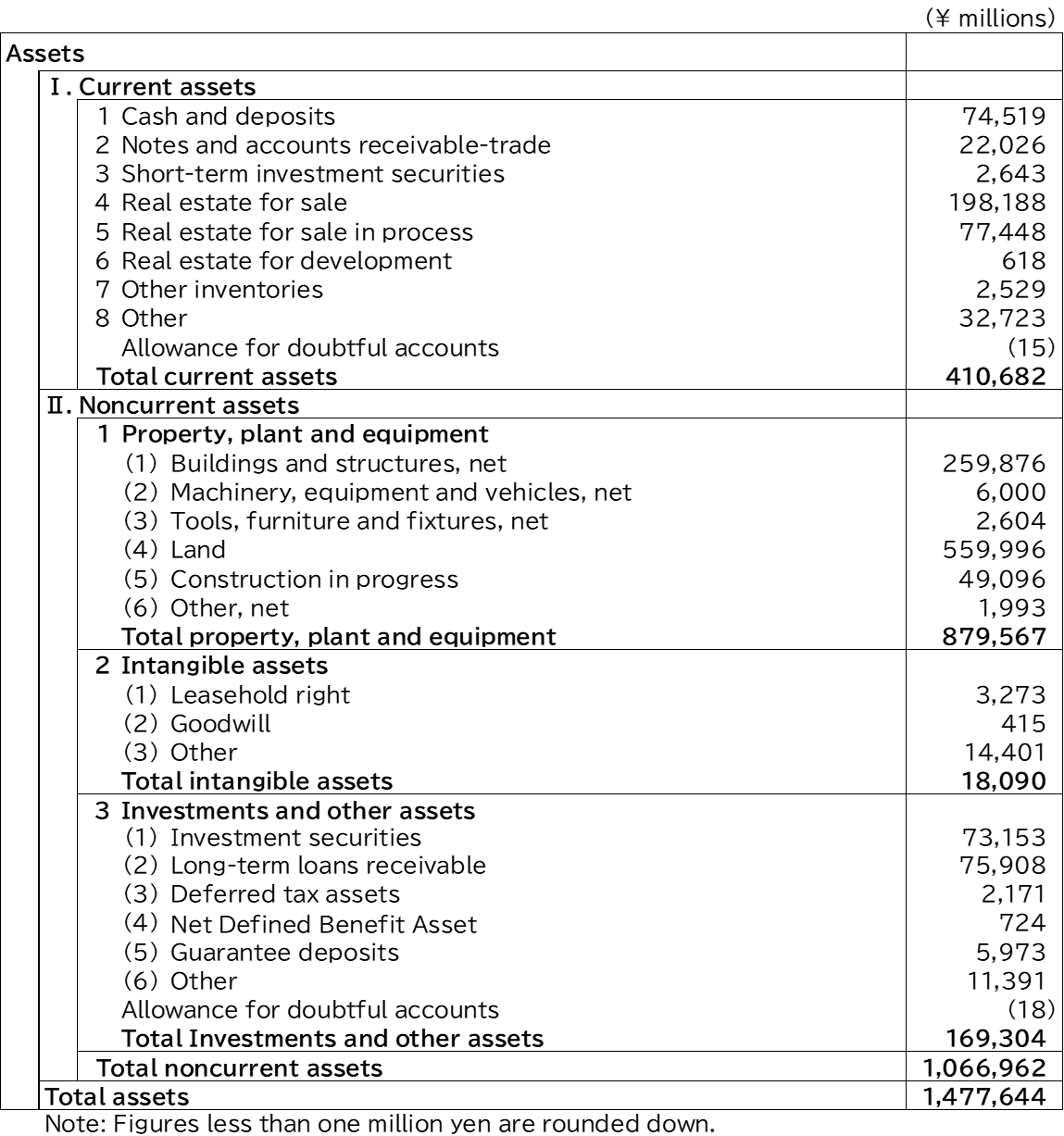

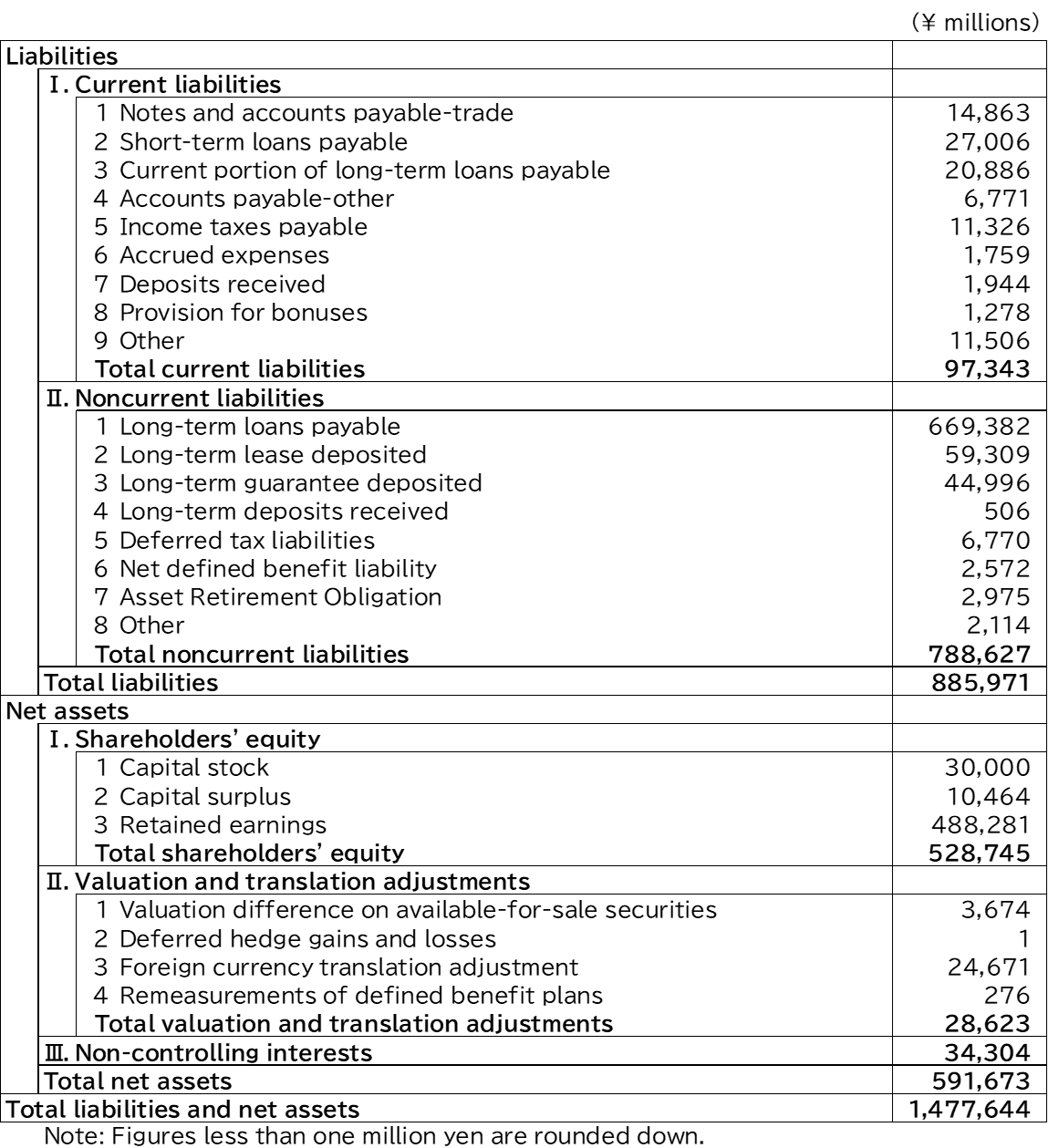

Consolidated Balance Sheets (as of March 31, 2024)

MORI TRUST CO., LTD. and its consolidated subsidiaries

Consolidated Statements of Income (For the years ended March 31, 2024)